What is Workers Compensation Insurance Aupeo: Exploring Its Benefits for Businesses

What is Workers Compensation Insurance Aupeo,in today’s business environment, effective management of workers’ compensation is crucial for both employee welfare and operational efficiency. This type of insurance covers medical costs and lost wages for injured employees, yet the claims process can often be complex and time-consuming.

AUPEO offers a cutting-edge technological solution that transforms how businesses manage these claims. By streamlining the process, AUPEO reduces errors and accelerates approval times. This efficiency alleviates administrative burdens, saving businesses both time and money.

Quick claim resolutions lead to higher employee satisfaction and productivity, allowing workers to focus on their tasks in a supportive environment. With AUPEO, organizations can enhance their workers’ compensation processes, enabling them to better support their teams and prioritize growth.

Understanding What is Workers Compensation Insurance Aupeo

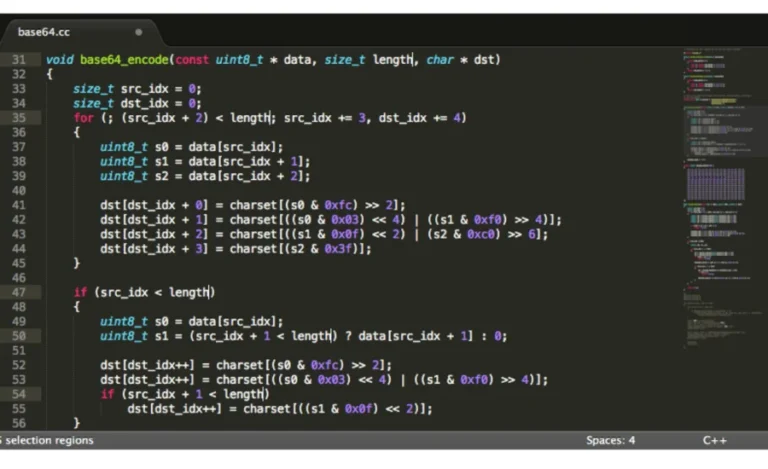

What is Workers Compensation Insurance Aupeo, which stands for Automated Underwriting and Processing for Efficient Operations, is an innovative technology system specifically tailored for workers’ compensation insurance. This advanced platform leverages sophisticated algorithms and comprehensive data analysis to enhance the efficiency of insurance processes.

By automating various tasks associated with workers’ compensation management, AUPEO significantly accelerates operations while ensuring greater accuracy. The system is designed to simplify the complexities often involved in insurance administration, ultimately leading to improved operational performance.

Businesses can anticipate a more efficient approach to workers’ compensation management with AUPEO, enabling speedier decision-making and fewer administrative constraints. This technology helps companies give their employees greater care while also improving the accuracy of insurance procedures.

The Transformative Role of AUPEO in Workers’ Compensation Insurance

What is Workers Compensation Insurance Aupeo plays a pivotal role in enhancing workers’ compensation insurance by streamlining various essential functions, including claims processing, risk assessment, and policy management. This innovative technology seamlessly integrates with existing insurance systems, which is vital for the modernization of workers’ compensation processes.

By fostering this connection, What is Workers Compensation Insurance Aupeo empowers both insurers and employers to manage policies and claims more efficiently. The integration allows for better data flow and communication, ultimately leading to improved decision-making and faster resolutions.

Anyone participating in workers’ compensation must comprehend the significance of AUPEO’s integration since it marks a major advancement in the field and improves the experience for all parties. AUPEO is modernizing processes and guaranteeing a more responsive and efficient workers’ compensation system with its creative approach.

The Importance of Workers’ Compensation Insurance for Employees and Employers

What is Workers Compensation Insurance Aupeo is necessary to ensure that injured workers receive the appropriate care and support they need to recover. It plays a critical role in safeguarding employees’ rights and promoting their wellbeing during their employment. By putting such coverage into place, organizations show their attention to the welfare and safety of their employees in addition to completing legal duties.

Apart from aiding workers, this insurance offers corporations substantial legal protection. It lessens the possibility of expensive legal conflicts by protecting companies against prospective lawsuits resulting from occupational injuries. Because of this, a lot of states have made it essential for businesses to get workers’ compensation insurance, realizing the importance of this coverage for both employee rights and workplace safety.

What is Workers Compensation Insurance Aupeo is necessary to ensure that injured workers receive the appropriate care and support they need to recover. It plays a critical role in safeguarding employees’ rights and promoting their wellbeing during their employment. By putting such coverage into place, organizations show their attention to the welfare and safety of their employees in addition to completing legal duties.

Key Components of Workers’ Compensation Insurance

Workers’ compensation insurance covers a number of crucial elements intended to assist workers who sustain injuries at work. This insurance covers medical costs, such as hospital stays, surgeries, and prescription drugs needed for healing, which is one of its main advantages. This guarantees that wounded workers won’t have to worry about paying for the care they require.

Workers’ compensation insurance also covers lost pay, which enables employees to continue living comfortably while they heal. A lot of insurance additionally cover the expense of rehabilitation, understanding how important it is to assist workers in their healing process and ensure a safe return to work.

It’s crucial to remember that businesses have unique legal requirements, which differ from state to state, regarding workers’ compensation. All jurisdictions do, however, have to comply with the requirement that employers offer health insurance to all of their staff members. Employers show their dedication to safeguarding their employees and promoting a secure and encouraging work environment by following these regulatory requirements.

The Necessity of Workers’ Compensation Insurance Across Various Industries

All kinds of businesses need What is Workers Compensation Insurance Aupeo, but especially those that employ people. In sectors where there is a greater chance of job injuries, like construction, manufacturing, and healthcare, this coverage is extremely important. While the majority of firms must have this insurance, some small company entities are excluded from this need since they might not be subject to the same legal requirements.

Since they are not considered employees, independent contractors or self-employed people who work alone usually do not require workers’ compensation insurance. It’s crucial to understand that state regulations pertaining to workers’ compensation can differ greatly, though. To guarantee compliance with the relevant standards, all employers should get familiar with their local rules. It is essential to comprehend these legal responsibilities in order to promote a secure workplace and safeguard the company and its workers.

Enhancing Workers’ Compensation Processes with AUPEO

AUPEO significantly enhances the management of workers’ compensation by streamlining several key processes. One of its primary advantages is the acceleration of claims processing, allowing for quicker resolutions and improved customer satisfaction. The system also minimizes errors in documentation, reducing the likelihood of costly mistakes that can delay claims.

Additionally, AUPEO employs advanced analytics to assess risks more accurately, enabling insurers to identify potential claims before they arise. This proactive approach not only enhances the efficiency of insurance operations but also helps mitigate future liabilities.

The integration of AUPEO into existing systems offers substantial benefits for both insurers and policyholders. By making processes more efficient, it can lead to significant cost savings while providing a higher level of service. This innovative technology ultimately transforms the landscape of workers’ compensation, ensuring that both employers and employees receive the support they need in a timely manner.

What is Workers Compensation Insurance Aupeo: A Comprehensive Guide

This guide seeks to clarify what workers’ compensation insurance is and how AUPEO can benefit both employees and businesses. In the United States and Brazil, workers’ compensation insurance is a crucial aspect of employee welfare and workplace safety measures. It provides essential protection for workers who experience job-related injuries or illnesses, ensuring they and their families have access to necessary financial support and medical coverage.

What is Workers Compensation Insurance Aupeo, we will explore the fundamentals of workers’ compensation insurance through AUPEO, highlighting its importance and the various stakeholders who can benefit from this policy. We will also discuss key considerations for businesses and employees when evaluating insurance options. By gaining a deeper understanding of this topic, both employers and employees can make informed decisions regarding workplace safety and insurance matters, ultimately fostering a healthier and more secure work environment.

The Importance of Workers’ Compensation Insurance in Supporting Injured Employees

What is Workers Compensation Insurance Aupeo who suffer diseases or accidents at work, workers’ compensation insurance is an essential safety net. This insurance plan is intended to pay for necessary medical expenses, rehabilitation expenditures, and a percentage of missed income while recovering. Its main goal is to guarantee that workers who are injured at work receive proper care without having to pay for it.

In Australia, workers’ compensation insurance is mandatory, although the specifics of the coverage can vary by state and territory. Therefore, understanding the local legal frameworks is crucial for employers to ensure compliance and provide necessary protections for their employees. Most employers are legally required to secure workers’ compensation insurance, reflecting the commitment to support their workforce.

A Personal Story Highlighting the Impact of Workers’ Compensation Insurance

What is Workers Compensation Insurance Aupeo, an employee at a manufacturing facility. He lost his hand as a result of a terrible injury he sustained one day while handling machinery. Due to this terrible tragedy, surgery and a lengthy recuperation period were required. Jake was lucky that his employer carried workers’ compensation insurance, which paid for his medical bills, his rehabilitation, and a portion of his lost income while he was receiving treatment.

Jake’s financial concerns were allayed by this help, allowing him to concentrate only on his recuperation. His story highlights the vital role that workers’ compensation insurance plays in promoting a safer and more encouraging work environment in addition to providing protection for employees.

The Essential Role of Workers’ Compensation Insurance in Protecting Employees and Employers

The primary objective of obtaining workers’ compensation insurance is to provide essential protection for employees. Workplace incidents can happen unexpectedly, often resulting in significant financial consequences. Workers’ compensation insurance ensures that employees receive necessary medical treatment and compensation for lost wages while they recover from work-related injuries or illnesses. This coverage offers peace of mind, especially during stressful times when employees are focused on their recovery.

Reducing Liability for Employers

For employers, workers’ compensation insurance plays a crucial role in minimizing potential liabilities. In the absence of such coverage, employees might seek compensation directly from their employers for losses stemming from workplace accidents. The workers’ compensation system operates on a no-fault basis, allowing employees to access benefits regardless of whether the employer was negligent. This not only protects employees’ interests but also shields employers from legal disputes, preserving their reputation and reducing financial risks.

Encouraging a Culture of Workplace Safety

Investing in workers’ compensation insurance also serves as an incentive for employers to prioritize and enhance workplace safety. By fostering a safe working environment, employers can reduce the likelihood of injuries, which in turn lowers insurance costs. A commitment to safety not only protects employees but also boosts overall morale and productivity. When employees feel secure in their work environment, they are more likely to be engaged and efficient, ultimately benefiting the entire organization.

Benefits of Workers’ Compensation Insurance for Employees and Employers

For Employees

Financial Stability During Recovery: Workers’ compensation insurance provides crucial financial support, allowing employees to concentrate on their recovery without the burden of lost wages. This security ensures that they can focus on healing rather than worrying about their financial situation.

Access to Essential Medical Treatment: With workers’ compensation coverage, employees can access necessary medical care without worrying about out-of-pocket expenses. This benefit ensures that they receive prompt and appropriate treatment for their work-related injuries or illnesses.

Confidence in the Workplace: Knowing they are protected in the event of a workplace injury offers employees peace of mind. This assurance enables them to perform their jobs with greater confidence, fostering a more positive and productive work environment.

For Employers

Mitigated Legal Risks: By offering workers’ compensation insurance, employers can significantly reduce their liability exposure related to workplace injuries. This coverage helps shield them from potential lawsuits, allowing them to focus on their business operations.

Enhanced Employee Satisfaction and Retention: Providing comprehensive workers’ compensation coverage can lead to increased employee satisfaction. When employees feel valued and protected, they are more likely to remain loyal to their employer, enhancing retention rates and reducing turnover costs.

Adherence to Legal Standards: In many regions, maintaining workers’ compensation insurance is a legal obligation for employers. By complying with these requirements, businesses can avoid fines and legal repercussions while demonstrating their commitment to employee welfare.

Why Choose Aupeo for Workers’ Compensation Insurance?

What is Workers Compensation Insurance Aupeo stands out as a premier provider of workers’ compensation insurance, delivering tailored solutions specifically designed for small businesses and freelancers. Here are several compelling reasons to consider partnering with Aupeo for your workers’ compensation needs.

Tailored Insurance Solutions

Aupeo understands that each business has unique requirements. Their customizable insurance plans allow business owners to select coverage options that align precisely with their specific needs, ensuring comprehensive protection for their workforce.

Dedicated Professional Support

Navigating the claims process can be complex, but Aupeo’s experienced team is committed to providing expert support. They offer valuable guidance to both employers and employees, ensuring that everyone understands their rights and responsibilities throughout the process.

Affordable Pricing

With competitive rates, Aupeo makes workers’ compensation insurance accessible for small businesses. This commitment to affordability enables businesses to prioritize employee protection without compromising their financial stability.

Extensive Educational Resources

Aupeo goes beyond just providing insurance; they equip businesses with a wealth of resources and information. Their comprehensive materials help organizations recognize the critical importance of workers’ compensation insurance and offer practical guidance on effective implementation.

Common Misconceptions About Workers’ Compensation Insurance

Misconception 1: Workers’ Compensation Insurance Is Optional

A prevalent misunderstanding among business owners is that workers’ compensation insurance is optional. In reality, it is a legal requirement in most states. Not providing this essential coverage can lead to significant penalties and legal repercussions, making it critical for businesses to understand their obligations.

Misconception 2: Only Large Companies Need Coverage

Another common myth is that only large corporations require workers’ compensation insurance. In truth, small businesses are just as vulnerable to workplace injuries as their larger counterparts. Often, smaller companies may be at a greater risk because they typically have fewer resources available for safety training and equipment, underscoring the necessity of comprehensive coverage regardless of company size.

Misconception 3: Workers’ Compensation Insurance Covers All Injuries

Many people believe that workers’ compensation insurance covers every injury sustained on the job. While it does provide coverage for most work-related injuries and illnesses, there are notable exceptions. For instance, injuries resulting from employee misconduct or those occurring during non-work-related activities typically do not qualify for coverage. Understanding these limitations is essential for both employers and employees to ensure they are adequately protected.

The Vital Role of Workers’ Compensation Insurance in Workplace Safety

Creating a robust safety framework is essential for businesses, regardless of their size. At the core of this framework is workers’ compensation insurance, which serves as a critical protection mechanism for both employers and employees against the financial burdens associated with job-related injuries and illnesses. Maintaining a safe and efficient workplace is paramount, and workers’ compensation plays a significant role in achieving this goal.

It provides crucial financial protection for employees affected by workplace injuries or illnesses, covering medical expenses and lost wages during recovery.

The insurance also offers a shield for employers against potential lawsuits by establishing a no-fault system for workplace accidents and related health issues.

Moreover, workers’ compensation promotes a culture of safety by incentivizing employers to prioritize the protection of their workforce and implement measures to prevent accidents.

By ensuring that employees have access to necessary medical care and income support during their recovery, workers’ compensation helps maintain workforce stability and productivity. For employers, this translates to reduced disruptions and lower costs associated with work-related injuries or illnesses.

Ultimately, the safety net provided by workers’ compensation insurance is indispensable for cultivating a secure and thriving workplace environment. It mitigates the financial and operational challenges posed by occupational hazards, making it an essential safeguard for businesses of all sizes.

Enhancing Workplace Safety with Aupeo’s Workers’ Compensation Insurance

What is Workers Compensation Insurance Aupeo, we understand the critical importance of safeguarding both your employees and your organization. Our workers’ compensation insurance is designed to help you navigate risks while fostering a safe working environment.

Our process begins with a thorough identification and assessment of workplace risks. Our team of experts conducts a detailed analysis of your work environment to pinpoint potential hazards. This proactive approach allows you to make informed decisions and implement appropriate safety measures.

Once risks are identified, our comprehensive coverage supports you in taking decisive action. We assist in establishing robust safety protocols and providing essential training to your workforce. Furthermore, we ensure that your employees have access to the necessary protective gear, enhancing their safety while on the job.

In the unfortunate event of an accident, our insurance provides crucial support for both your employees and your business. It covers medical expenses and compensates for lost wages, demonstrating your commitment to employee well-being and helping to maintain stability within your organization.

What is Workers Compensation Insurance Aupeo, we view effective workplace risk management as the cornerstone of a successful business strategy. Our workers’ compensation insurance serves as a powerful tool to create a safer work environment while protecting the financial health of both your employees and your company.

Dispelling Common Myths About Workers’ Compensation Insurance

Many misconceptions surround workers’ compensation insurance, leading to confusion among employees and employers alike. One prevalent myth is that employees are ineligible for benefits if they were responsible for their own injuries. However, with Aupeo’s workers’ compensation insurance, this is not the case. The system is designed to provide support and benefits to employees regardless of who is at fault for the incident.

This no-fault aspect of workers’ compensation insurance is crucial, as it ensures that employees receive the necessary medical care and financial assistance during their recovery, allowing them to focus on healing rather than worrying about liability. By clarifying these misconceptions, both employees and employers can make more informed decisions regarding workplace safety and insurance coverage.

Understanding Workers’ Compensation Insurance Premiums

Employers are required to pay premiums for workers’ compensation insurance, which can vary significantly depending on the level of risk associated with different job roles. For example, premiums for construction workers typically tend to be higher due to the inherent dangers of the construction environment, while those for office workers are generally lower given their safer work conditions.

To manage and potentially lower these costs, employers can adopt comprehensive safety measures and provide regular training for their employees. By prioritizing workplace safety, companies not only enhance the well-being of their staff but also position themselves to benefit from reduced insurance premiums over time. Implementing effective safety protocols demonstrates a commitment to employee protection and can ultimately lead to a more productive and secure work environment.

Final Words

What is Workers Compensation Insurance Aupeo, especially through providers like Aupeo, is a vital safeguard for both employees and employers. This type of insurance is designed to offer financial support and medical coverage to employees who suffer work-related injuries or illnesses. Aupeo’s workers’ compensation insurance stands out for its tailored solutions, catering to the unique needs of small businesses and freelancers.

It ensures that employees receive necessary medical treatment without incurring out-of-pocket costs, allowing them to focus on recovery without the stress of lost wages. For employers, this insurance reduces the risk of legal liabilities and promotes a culture of workplace safety. By having this coverage, businesses can maintain a stable workforce, demonstrating their commitment to employee welfare. Understanding What is Workers Compensation Insurance Aupeo is and how Aupeo can benefit your organization is essential for fostering a safe and supportive work environment.

Stay in the loop for upcoming updates and alerts! latest Drift