Qtech Software Equity And Face Value Drive Innovation

Qtech Software Equity And Face Value In the ever-evolving digital landscape, the concept of software equity is becoming increasingly important as organizations strive to harness technology for growth and maintain a competitive edge. But what does software equity truly entail, and why does it matter? This article explores the intricacies of software equity, highlighting its relevance, advantages, challenges, and emerging trends.

At its core, software equity refers to the strategic value that software brings to a business, encompassing not just the financial aspects but also the potential for innovation and operational efficiency. In a world where technology plays a crucial role in business success, understanding and leveraging software equity can significantly influence an organization’s trajectory.

The importance of software equity lies in its ability to drive growth and foster innovation. As businesses increasingly integrate advanced technologies into their operations, they can unlock new revenue streams, improve customer experiences, and enhance decision-making processes. This shift not only leads to increased market competitiveness but also helps organizations adapt to the rapidly changing technological landscape.

Transforming Travel with qtech software equity and face value

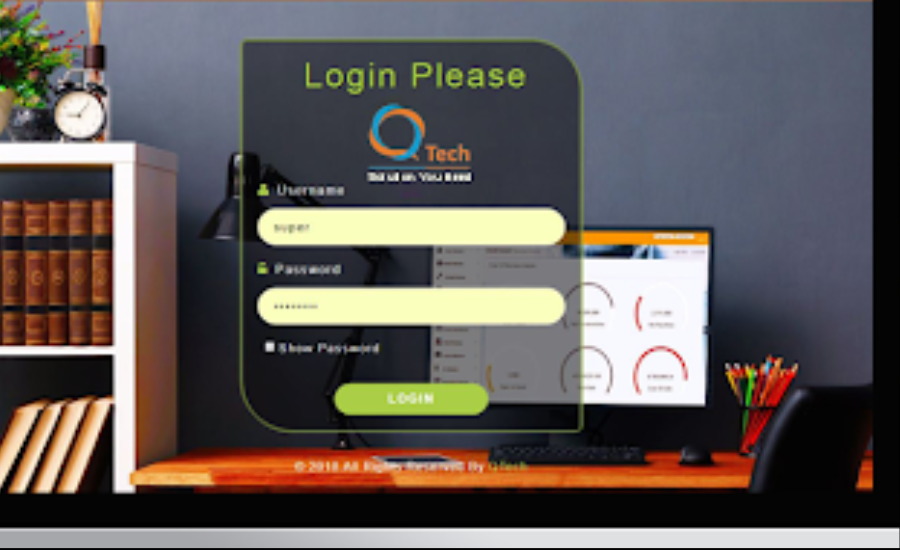

With a vision to transform the travel industry,qtech software equity and face value has dedicated over ten years to providing outstanding software solutions for travel businesses globally. The company excels in offering technology designed specifically for online travel agencies (OTAs), tour operators, and travel management firms. What distinguishes qtech software equity and face value is its unwavering commitment to client satisfaction and its ability to create customized solutions that cater to the specific requirements of each business.

By developing innovative travel portals, integrated booking engines, and bespoke UX/UI designs, Qtech Software has empowered its clients to enhance their operational efficiency, boost productivity, and increase profitability. This client-focused strategy has been vital in driving the company’s consistent growth.

However, Qtech’s expansion is not solely attributed to its cutting-edge software solutions. A strong financial structure is equally crucial. Understanding key concepts like equity and face value can provide valuable insights into how companies like qtech software equity and face value achieve sustainable success. By marrying innovative technology with sound financial practices, Qtech Software is well-positioned to lead the way in the travel industry’s digital transformation.

Understanding Equity in qtech software equity and face value

In the realm of finance, equity signifies the value of an owner’s stake in a company, commonly reflected through share ownership. When a business issues shares, it effectively sells a fraction of ownership to investors in exchange for capital. The overall equity of a company serves as a gauge of its net worth, indicating the value that remains after deducting liabilities from total assets. Essentially, equity embodies the financial interest shareholders possess in the enterprise.

For a company like qtech software equity and face value, equity plays a vital role in fostering growth and innovation. By offering equity stakes to investors, qtech software equity and face value can secure the funding necessary to broaden its operations, invest in cutting-edge technologies, and explore new markets. The company’s impressive expansion to over 50 clients across 36 countries illustrates its ability to utilize equity effectively, driving its growth initiatives and establishing a strong foothold in the global travel technology sector.

The Role of Equity in Technology Firms

Equity holds a crucial place in the landscape of technology companies like Qtech Software, which often need substantial investments to create innovative products, enhance existing software, and maintain a competitive edge. By raising equity, these firms can tap into the financial resources essential for rapid innovation and growth. In exchange, investors gain a stake in the company’s potential success, with opportunities for significant returns as the business scales and its value increases.

Moreover, technology companies frequently utilize equity as a strategy to attract and retain top talent. By offering stock options or shares, Qtech can align employee interests with the organization’s overall success. This type of compensation not only motivates employees to work toward long-term objectives but also fosters a sense of ownership and commitment to the company’s performance, ultimately contributing to its sustained growth and success in the industry.

Understanding Face Value in Shares

Face value, often referred to as nominal value, represents the original price of a share as indicated on the stock certificate. This value remains constant over time and does not fluctuate with changes in the market value of the share. Typically set at a modest amount, such as $1 or $10, face value serves as a reference point for calculating various financial metrics. However, the market value—shaped by supply and demand dynamics—can vary significantly from this fixed nominal value.

For both companies and investors, face value holds significance as it influences share pricing and trading strategies in the marketplace. For Qtech Software, a clear understanding of its shares’ face value can aid in making informed decisions about issuing new shares or securing additional capital. Meanwhile, for investors, face value provides insight into the minimum worth of a share, although it is the market value that ultimately reflects the stock’s current pricing and performance. This dual perspective on face value helps to navigate the complexities of equity investment and corporate finance.

The Impact of Equity and Face Value on Qtech Software’s Growth

By raising equity, the company can accelerate its growth trajectory, invest in research and development, and continue delivering cutting-edge software solutions to its diverse clientele. Additionally, a solid grasp of face value allows Qtech to maintain transparency with its investors, ensuring that its shares are priced fairly in the marketplace.

Qtech’s business model is founded on principles of scalability and adaptability. The company’s ability to customize its travel technology solutions for various clients enables it to cater to a broad spectrum of businesses, from small tour operators to large travel agencies. By effectively leveraging equity to support this scalable model, Qtech can consistently enhance its software offerings and penetrate new markets. This strategic approach not only fosters innovation but also increases the overall value of its shares, positioning Qtech for long-term success in the competitive travel technology sector.

Equity Funding: A Catalyst for Qtech’s Global Expansion

A significant driver behind Qtech Software’s international success is its ability to secure equity funding, which has been instrumental in supporting its expansion initiatives. As the company sought to grow, it required additional capital to establish a foothold in new countries, forge relationships with local clients, and tailor its solutions to cater to the unique demands of each market.

By harnessing equity funding, Qtech has been able to accelerate its global expansion and position itself as a leader in the travel technology sector. This strategy of offering shares to investors has enabled the company to raise essential capital for growth without incurring excessive debt or jeopardizing its financial stability. Consequently, Qtech has managed to uphold a robust balance sheet while consistently delivering value to its shareholders, ensuring a sustainable path forward in a competitive industry.

The Impact of Financial Structure on Qtech’s Client Services

The financial structure of Qtech Software, bolstered by equity investments, significantly influences the company’s capacity to meet its clients’ needs. With access to essential capital, Qtech can channel resources into developing advanced technology solutions that align with the ever-evolving demands of the travel industry. This capability enables the company to equip its clients with the tools necessary to remain competitive in a rapidly changing market.

Qtech’s commitment to innovation and client satisfaction has been pivotal to its success, with its financial framework playing an essential role in underpinning these initiatives. By raising equity, the company has effectively invested in research and development, broadened its product offerings, and improved its customer service capabilities. These enhancements not only benefit Qtech’s clients but also contribute to the company’s long-term business success, reinforcing its position in the travel technology sector.

Understanding Face Value vs. Market Value for Investors

For investors, grasping the distinction between face value and market value is crucial when assessing a company’s shares. Face value serves as a foundational indicator of the original price of a share, while market value reflects the company’s current performance and future prospects.

As Qtech Software has expanded its operations and achieved notable success in the travel technology sector, its market value has likely risen over time. For those investors who acquired shares at face value, this increase in market value signifies a substantial return on their investment. However, it is essential to recognize that market value can fluctuate due to a myriad of factors, including the company’s financial performance, prevailing industry trends, and overall market conditions. Understanding these dynamics can help investors make informed decisions in a constantly changing financial landscape.

Qtech Software’s Strategic Financial Outlook

As Qtech Software forges ahead in the global travel technology market, its financial structure, encompassing equity and face value, will be pivotal to its ongoing success. By strategically leveraging equity to secure capital for expansion initiatives, Qtech can persist in its innovation efforts, delivering substantial value to both clients and shareholders.

Looking toward the future, Qtech is well-equipped to take advantage of emerging trends within the travel industry. These include a growing demand for personalized travel experiences, the increasing prevalence of mobile travel applications, and the heightened importance of data-driven decision-making. With a robust financial foundation and a steadfast commitment to client satisfaction, Qtech Software is poised for sustained success in the years ahead, reinforcing its position as a leader in the travel technology sector.

Strategies for Implementing Software Equity in Organizations

To cultivate software equity within organizations, a strategic approach is essential. The first step involves assessing the specific software needs of the organization. This includes identifying the tools currently in use, understanding the challenges employees encounter, and pinpointing any gaps in accessibility. Engaging with team members to gather their insights and experiences is crucial for a comprehensive understanding.

Investing in training is another vital aspect. Organizations should provide robust training programs to ensure all employees are proficient in using the software. Options can include workshops, online tutorials, and mentorship initiatives. Such investments not only empower employees but also boost overall productivity.

Fostering diversity in the workplace is key to developing more equitable software solutions. A diverse workforce brings a range of perspectives and experiences, which can help identify areas where software may not meet the needs of all users effectively.

Lastly, implementing software equity is an ongoing commitment. Regular evaluations of the software tools in use, coupled with user feedback, are essential to identify improvement areas. Organizations should remain informed about new developments in software and technology to ensure continued equity and adaptability in their tools and practices. By following these strategies, organizations can create a more inclusive environment that enhances both employee satisfaction and overall performance.

Emerging Trends in Software Equity

As technology continues to advance, the concept of software equity is also poised to evolve. One prominent trend to watch is the increasing emphasis on artificial intelligence (AI) and automation. These technologies are reshaping the software landscape, and it will be essential for organizations to ensure equitable access to AI tools for all users, regardless of their technical proficiency. Making these tools accessible is crucial for fostering an inclusive environment.

The shift toward remote work has further highlighted the necessity of software equity. With more organizations embracing hybrid or fully remote work models, ensuring equitable access to collaboration tools and resources becomes vital. This access is key to maintaining productivity and engagement among team members.

Additionally, as software becomes integral to everyday business operations, concerns surrounding security and privacy are likely to intensify. It is essential that all users understand security protocols and have access to secure software solutions. This focus on security will play a significant role in creating a fair digital environment for everyone.

Finally, promoting digital literacy will be a critical aspect of achieving software equity. Collaboration among organizations, educational institutions, and governments will be necessary to provide the training and resources that empower individuals to navigate the digital landscape confidently. By staying ahead of these trends, organizations can better position themselves to create an equitable software ecosystem for all users.

Final Words

Qtech Software exemplifies how a robust financial structure, encompassing equity and face value, can drive growth and innovation in the travel technology sector. By strategically leveraging equity investments, Qtech has been able to expand its operations, invest in cutting-edge solutions, and cater to the diverse needs of its clients worldwide. Understanding the distinction between face value and market value is essential for investors, as it provides insight into the company’s financial health and potential returns. As Qtech continues to navigate the evolving digital landscape, its commitment to client satisfaction and effective use of equity will remain critical to its success. By harnessing these financial strategies, Qtech Software is poised to lead the way in delivering exceptional technology solutions, reinforcing its position as a key player in the travel industry.

For insights on how software equity shapes the future of technology and business, stay connected with Latest Drift.